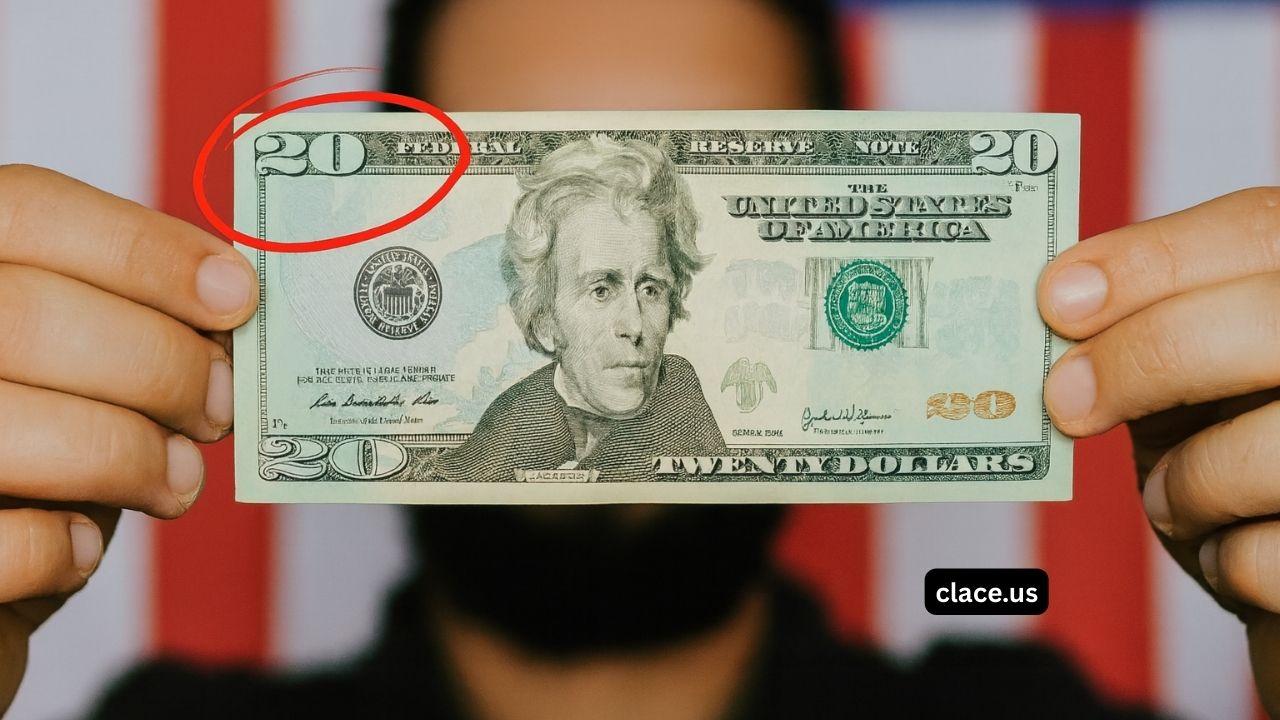

$20 Bill With Upside-Down Seal Turns Into $95,000 Collectible – Check Yours Today

If you’ve heard buzz that a $20 bill with an upside-down seal could be worth life-changing money, you’re not alone.

In paper-money terms, that “upside-down seal” is an inverted overprint—a real Bureau of Engraving & Printing (BEP) printing error where the green Treasury seal and serial numbers are applied in the wrong orientation during the third printing.

These are collectible and, in exceptional cases, can sell for five-figure prices—though most examples trade for far less.

What exactly is an inverted overprint (upside-down seal)?

U.S. banknotes are printed in multiple stages. Serial numbers and the Treasury seal are added last; if a sheet is rotated 180° before that pass, the note shows an upside-down seal/serials while the rest of the design looks normal. Authentication experts highlight this as a recognized error category.

Can an upside-down-seal $20 really reach $95,000?

Reality check: verified public auction records show that spectacular $20 error notes can achieve huge numbers—the record belongs to the famous “Del Monte” obstructed-overprint $20 that realized $396,000 in 2021.

But that note involved a foreign object in the press, not merely an inverted seal. Typical inverted-overprint notes (including $20s) generally sell from the hundreds to low thousands, depending on series and grade.

Some rare or high-grade inverted overprints (various denominations) have topped five figures, but $95,000 would require truly extraordinary factors (e.g., elite provenance, multiple error types, or museum-level rarity).

What are today’s market ranges?

Below is a snapshot from recent guides and auction archives to frame expectations:

| Error / Feature | Typical 2025 Market Range | Notable Public Results | Notes |

|---|---|---|---|

| Inverted overprint (upside-down seal) on common modern notes | $300–$2,500+ (grade-dependent) | Selected inverted overprints in top condition have exceeded $10,000 (various denoms). | Routine examples are collectible but not ultra-rare; grade and eye appeal matter most. |

| $20 inverted overprint (representative older sales) | Hundreds–low thousands | A Series 1974 $20 with inverted overprint brought $431 (PCGS 63) in 2010. | Illustrates that not all inverted seals command big money. |

| Double/dual denomination errors (e.g., $20 face / $10 back) | $25,000–$60,000+ | 1974 $20/$10 examples realized $27,600 (2011) and $37,600 (2016). | Among the most coveted paper-money errors. |

| Record $20 error (different error type) | — | $396,000 for the “Del Monte” obstructed-overprint $20 (2021). | Shows top end of the error-note market, but not an inverted-seal case. |

How to spot a valuable note

- Look for a clearly upside-down green seal and both serial numbers while the rest of the note is correctly oriented. Use good lighting and a loupe.

- Beware of altered or counterfeit “errors.” Professional graders (PMG/PCGS Banknote) publish guides for detecting fakes and can certify authenticity.

What drives value?

- Grade & eye appeal: Crisp, well-centered, original notes bring premiums.

- Series/district & scarcity: Some runs are far scarcer than others; rare pairings push prices higher.

- Certification: PMG/PCGS holders reassure buyers and unlock auction demand.

- Error drama: Combining errors (e.g., double denomination) can propel a $20 error into the five-figure club.

How to sell if you’ve got one

If your $20 appears genuine, do not clean or flatten it. Get it professionally graded and consign to a major currency auction house with a track record for error notes; this is where headline results are achieved.

A $20 bill with an upside-down seal is a legitimate BEP error and absolutely collectible. While many examples bring hundreds to low-thousands, only extraordinary pieces—with superb grade, certification, and rarity—press into five-figure territory.

To hit something like $95,000, a note would almost certainly need standout factors beyond a basic inverted seal. Check your wallet—but verify and grade before you celebrate.